It’s no secret that Google’s blocked in Mainland China.

Yet, for Chinese website owners checking Google Search Console data, a puzzling trend appears: visitors from China. Right there in the “Countries” tab, under performance reports—impressions and clicks from Chinese users. But how, if Google’s banned?

The answer lies in VPNs, which, though technically restricted, are surprisingly common. Many people use VPNs to access Google, social media, or other blocked services. And while VPNs mask a user’s location—making them appear to be browsing from the USA, Singapore, or Japan—Google seems to recognize certain IP ranges linked to popular VPN providers in China, marking these users as from China in Search Console data.

Combine this with GSC search analytics showing steady visits from Simplified Chinese searches, and it’s clear: Google’s being accessed in China more than we might think.

So what’s driving this trend? It’s more than just curiosity about Google. There seem to be solid reasons why VPN use—and with it, Google’s market share—is quietly rising, even in a country where it’s officially off-limits.

VPNs—The Open Secret

VPNs in China? Technically illegal, but let’s be real—they’re everywhere. From students and researchers to business professionals, VPNs have become a quiet staple, a tool almost as common as a smartphone app. Despite the official crackdown, it’s not hard to find a VPN through local providers, often marketed with a wink and nod as “private networks” or “secure browsing solutions.”

People in China use VPNs to access what’s otherwise locked down: global news, social media, even foreign shopping sites. It’s their door to the internet beyond the Great Firewall, and, for many, it’s worth a small subscription fee to get unrestricted access. Want to use Google, watch an international news site, or try a Western AI tool? VPNs make it possible. And as more people connect through these backdoor channels, Google quietly gains a foothold, becoming one of the first tools they try out on the “other side.”

Why People Really Use VPNs (And How Google Becomes Part of the Package)

People don’t grab a VPN just to search on Google. It’s about accessing tools and platforms that Chinese networks can’t reach. But once they’re in, Google quickly becomes part of the package.

Take AI tools like ChatGPT and DALL-E. Big in the West, completely off-limits in China without a VPN. Curious users connect to try them out, and once they’re there, it’s only natural to jump to Google for more ideas or info.

Then there’s the business angle. Many Chinese companies need access to global platforms—Google Ads, Meta, LinkedIn—to stay competitive. For local marketing teams, VPNs are standard. And with that, Google becomes part of their daily workflow, essential for both search and insights.

Lastly, Google Translate and educational resources. When Baidu Fanyi falls short, Google Translate steps up, especially for academic or technical translations. Once people are using Google’s ecosystem, sticking around for search is an easy call.

So while VPNs aren’t about Google alone, Google’s just a small step away—growing its presence in China one click at a time.

Google’s Clean Search vs. Baidu’s Ad-Overload

And once users try Google, they often realize—wow, the search results are different. Cleaner, more comprehensive, and with far fewer ads. Google isn’t just crawling the non-Chinese internet; it’s indexing Chinese websites, even those hosted within Mainland China. Sure, some sites block Google’s crawlers and won’t show up in its search results, but the majority that do allow Google’s bots have a better shot at ranking well than on Baidu.

This isn’t only about fewer ads. Google’s algorithms prioritize content quality, incorporating EEAT influenced elements (Experience, Expertise, Authoritativeness, and Trustworthiness). Even if EEAT isn’t a direct ranking factor, Google’s machine learning has likely absorbed insights from quality raters’ feedback, making EEAT criteria a subtle yet influential part of how search results are evaluated.

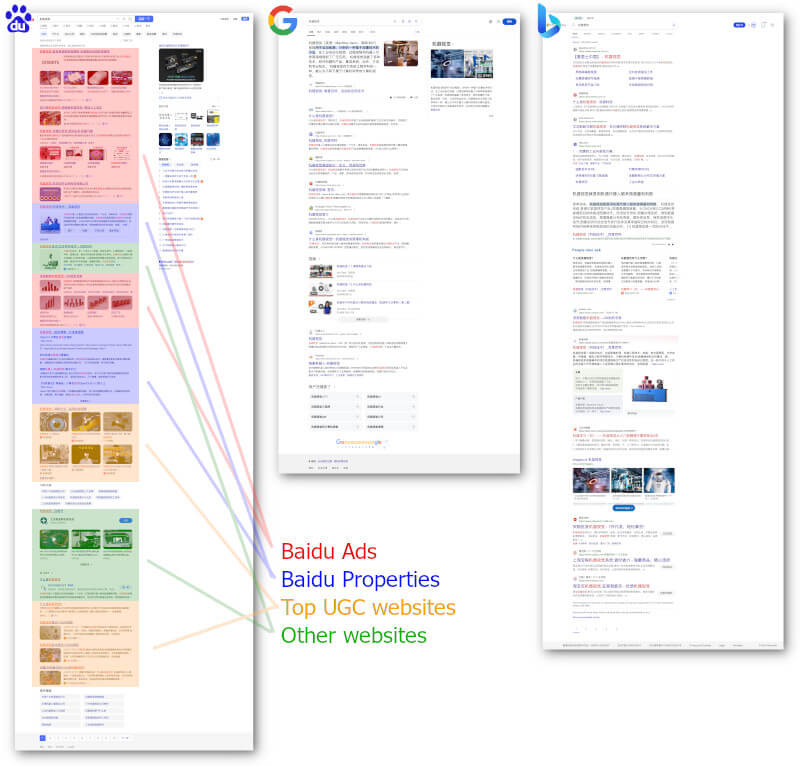

For many users, the result is a refreshingly broad view: niche sites, independent voices, and a variety of perspectives—all much easier to find on Google – and literally no Ads on Google (why should companies buy ads for a search engine banned in China?). Baidu, by contrast, can feel like one long ad reel, favoring high-authority sites, internal platforms like Baike, Zhidao, Baijiahao and top UGC services like Zhihu, Bilibili, and iQiyi. Google’s open, varied approach is a breath of fresh air for those who are used to Baidu’s more controlled landscape, and it’s no wonder why they might keep coming back.

Google’s Quiet Rise in China

Despite being officially blocked, Google’s making inroads in China. With VPNs and a rising demand for cleaner, diverse search results, it’s quietly growing. As of October 2024, Google’s market share in China has reached around 19%—a surprising figure, given the restrictions.

For users seeking less bias and fewer ads, Google’s appeal is strong. And with its algorithms indexing Chinese content effectively, it’s becoming a real alternative to Baidu.

What do you think? Have you seen similar trends? Let us know your take on Google’s unexpected growth in China.

About the author: Marcus Pentzek, Director of SEO, Jademond Digital - Marcus Pentzek has been shaping the SEO landscape since 2008, beginning as a consultant in Germany and later pioneering SEO strategies at Searchmetrics GmbH. His deep dive into the Chinese market began in 2012 while directing marketing at Yoybuy Ltd in Beijing, gaining firsthand experience in e-commerce SEO in China. Since 2022, he leads SEO at Jademond Digital, focusing on innovative, data-driven methods tailored for Chinese audiences. His blog posts merge over a decade of global SEO expertise with practical insights into the Chinese digital environment.