At Jademond, we track search engine market shares in China to address the lack of reliable data. Combining desktop and mobile insights, we provide a clear view of key players like Baidu, Bing, Google, 360 Search, Sogou, Toutiao, and Shenma. This month, our expanded analysis includes new platforms, offering even deeper insights into China’s evolving search landscape.

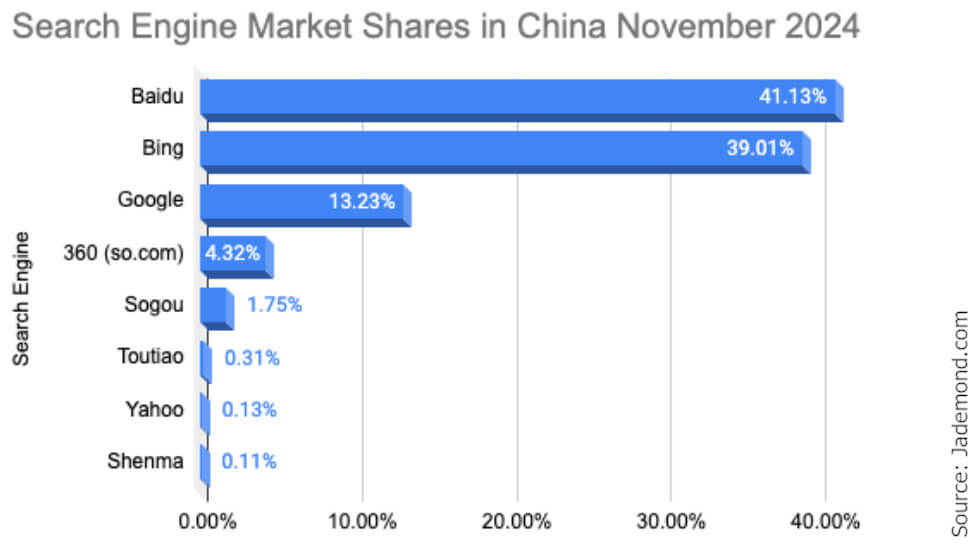

In November 2024, Baidu solidified its leadership position, increasing its market share to 41%, while Bing surged to 39%, narrowing the gap significantly. Google saw a sharp decline, dropping to 13% from 19% last month, as local platforms continued to dominate. 360 Search and Sogou maintained their positions with minor fluctuations, holding steady at 4% and 2%, respectively. New entrants like Toutiao and Shenma, although small players, highlight the growing diversification in China’s search ecosystem. This evolving landscape underscores the importance of tracking monthly shifts to adapt strategies effectively.

Key Observations

- Baidu maintains its leadership, gaining a modest 1.7% market share to reach 41.13%.

- Bing makes significant gains, closing the gap with Baidu by growing 3.9% to hold 39.01% of the market.

- Google faces a sharp decline, dropping 5.6% to 13.23%, likely due to ongoing restrictions and user preference shifts.

- 360 (so.com) and Sogou hold steady in the low-single digits, with minor dips.

- New data sources allow us to track Toutiao and Shenma, revealing their small but noteworthy contributions.

Why calculating our own Search Engine Market Share data?

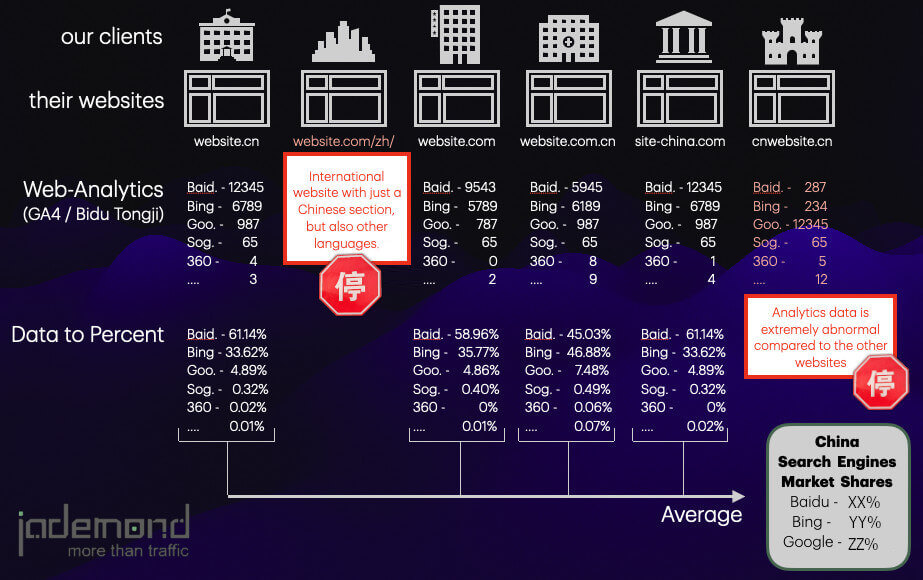

Our approach to tracking search engine market shares in China stems from a lack of reliable sources, as no official data has been available for quite some time. Since spring of last year, we began distrusting Statcounter’s data due to irregularities that seemed implausible. Upon closer inspection, we found their data sample for China to be too random, likely irrelevant, and too small to be reliable. This prompted us to turn to our own data sources, gathered through GA4, Baidu Analytics, and various Search Consoles/Webmaster Tools from our China SEO clients.

Who is our data relevant for?

While one could argue that our sample size is smaller than Statcounter’s, we believe our data is more relevant and representative for our clients, as it comes directly from them. Our clients are primarily B2B businesses selling in China, so the data reflects this specific target group.

Our Methodology

We focus exclusively on Chinese websites, removing any multilingual sites from the data pool. We then look at visitor numbers from organic search traffic in GA4 and Baidu Analytics (Tongji), calculating the percentage share for each search engine.

To verify these percentages, we cross-check click data from Webmaster Tools/GSC, particularly for Baidu, Bing, and Google. Finally, we take the average percentage values across our data set to provide an accurate representation of search engine market shares relevant to our clients.

Search engine market shares in China explained

A lot of people in China, yeah, they’re mostly using their smartphones and apps like WeChat or Xiaohongshu to find stuff—whether it’s topics, content, or whatever.

But let’s not write off the good old websites just yet. Despite what some social media consultants might say, websites and the search engines that help people find them are still very much alive. And when it comes to searching for websites, Baidu is still the big player in China. They even call it the “Google of China.”

Sure, at first glance, it does seem like Baidu is just China’s version of Google. But the reality? Totally different rules when it comes to getting the best results out of Baidu.

And you know what? Bing is actually getting pretty big too, especially for businesses and professional searches. Crazy, right? And here’s the kicker—even Google is making a bit of a comeback, despite being blocked in China.

More and more people in China are using VPNs to access it. Some of them are even showing up as Chinese users in Google’s Search Console data, but others? Well, they’re “officially” coming from places like Hong Kong, Taiwan, Singapore, South Korea, or even the U.S.—but they’re definitely still sitting in China.

Frequently Asked Questions (FAQs)

Which search engine has the highest market share in China?

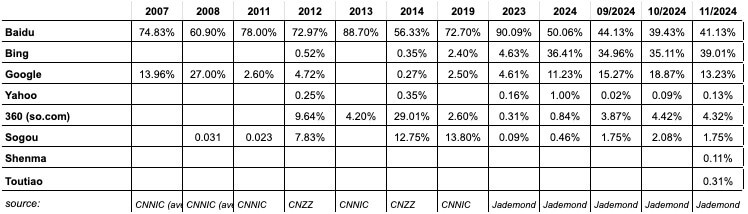

In 2024, Baidu continues to lead the search engine market in China with a 45.73% share across all platforms. Bing follows closely with 33.26%, marking significant growth. Google holds 10.26% of the market, despite being officially blocked in the country. Yahoo has a small share at 0.91%, while Qihoo (also known as 360search, Haosou, or so.com) accounts for 0.77%. Sogou rounds out the list with a 0.42% share.

Search engine market share in China, Summer 2024:

- Baidu: 60.06%

- Bing: 36.41%

- Google: 11.23%

- Yahoo: 1%

- Qihoo (360search / Haosou / so.com): 0.84%

- Sogou: 0.46%

What is China’s main search engine?

Baidu is the most used search engine in China, controlling 45.73 percent of China’s market share. It’s often compared to Google but operates differently with a focus on the Chinese language and market.

What is Baidu’s market share?

Baidu currently holds about 45.37% of the market. It used to be as high as 90%, but competition has been growing.

Why is Baidu more popular than Google in China?

Baidu is more popular than Google in China for several reasons. As a Chinese company, Baidu fully complies with local laws and censorship, giving it the freedom to operate without restrictions, while Google is blocked. This undoubtedly benefits Baidu, as it faces no direct competition from Google within the country. Additionally, Baidu has a deeper understanding of the Chinese language and culture, allowing it to optimize its search results to better meet the needs of local users. That said, the number of users accessing Google via VPN has been growing recently, though it still remains a small percentage compared to Baidu’s user base.

Which country uses Baidu the most?

Baidu is the dominant search engine in China, with over 45% market share. It’s specifically designed for the Chinese market, making it the go-to search engine for users in China. While its usage is mostly limited to China, it remains essential for companies looking to reach Chinese consumers online.

Does China use Google?

Google is officially blocked in China, so it doesn’t have the strong presence there that it enjoys in most other countries. However, despite the restrictions, around 10% of the market share in China still goes to Google, largely due to users accessing it via VPNs. While Baidu remains the dominant search engine, the number of people in China finding ways to use Google has been steadily growing.

Is Bing popular in China?

Bing is the second most popular search engine in China, with over 30% of the market share, making it a significant player, especially on desktops. Unlike Google, which is blocked in China, Bing remains accessible by complying with Chinese regulations. Its rise in popularity is a big shift from just a few years ago, as it now serves as the dominant Western search engine in the country. However, this success has come with compromises, as Bing must follow local rules to remain available in the Chinese market.

What is China’s top search engine?

Baidu is the most popular search engine in China, often compared to Google in the Western world. As one of the first search engines in China, it has maintained its leading position over the years, holding the largest market share. While other players like Bing are gaining ground, Baidu remains the dominant search engine for Chinese users.

Does Hong Kong use Baidu?

Unlike mainland China, Google is freely accessible in Hong Kong, making it the preferred search engine for most people living there. However, some Mainland Chinese residents in Hong Kong may still use Baidu, especially when searching for Simplified Chinese websites, although Google is also capable of handling Simplified Chinese searches effectively. Overall, Baidu is used less frequently in Hong Kong compared to Google.

Is Google censored in China?

Yes, Google search is blocked in mainland China. While Google services aren’t completely banned everywhere, access is heavily restricted. Some users bypass these blocks by using virtual private networks (VPNs) to access Google, though the Chinese government has been tightening its crackdown on VPN usage. Despite these efforts, many users still find ways to use Google services, though it remains far from easily accessible.

About the author: Marcus Pentzek, Director of SEO, Jademond Digital - Marcus Pentzek has been shaping the SEO landscape since 2008, beginning as a consultant in Germany and later pioneering SEO strategies at Searchmetrics GmbH. His deep dive into the Chinese market began in 2012 while directing marketing at Yoybuy Ltd in Beijing, gaining firsthand experience in e-commerce SEO in China. Since 2022, he leads SEO at Jademond Digital, focusing on innovative, data-driven methods tailored for Chinese audiences. His blog posts merge over a decade of global SEO expertise with practical insights into the Chinese digital environment.